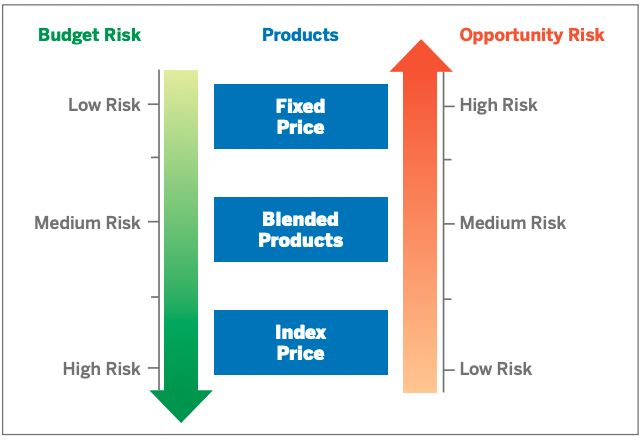

How Your Tolerance for Risk Should Affect Your Energy Purchasing Strategy

Managing your energy procurement strategy and budget requires a delicate balance of risk: You want the opportunity to achieve cost savings based on market highs and lows — but you also need to be able to accurately forecast your budget.

Below, learn how different energy purchasing strategies align with risk and opportunity to choose the best strategy — and make the best decisions — for your company.

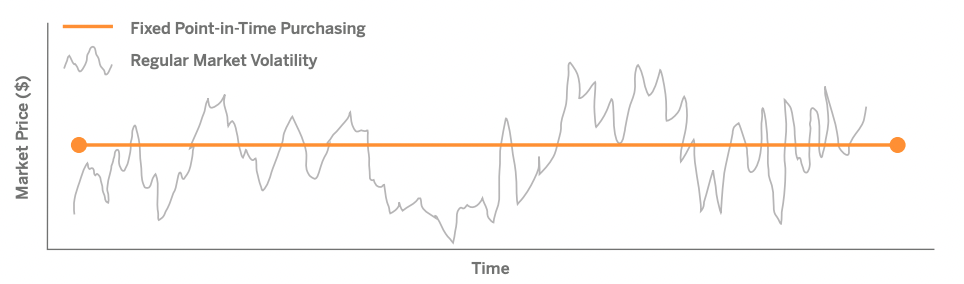

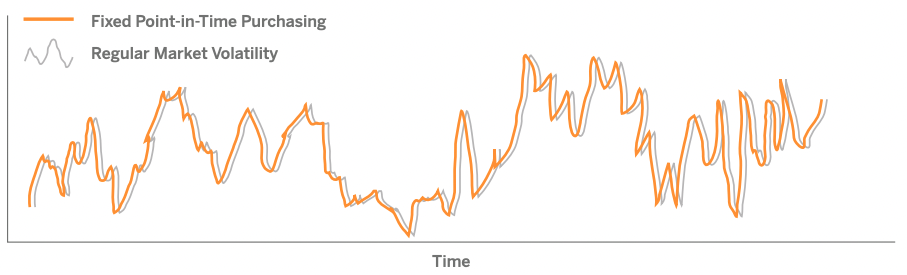

Fixed or Secured Price*

A fixed price purchasing strategy can provide budget certainty, but does not allow you to take advantage of market dips and possible related cost savings.

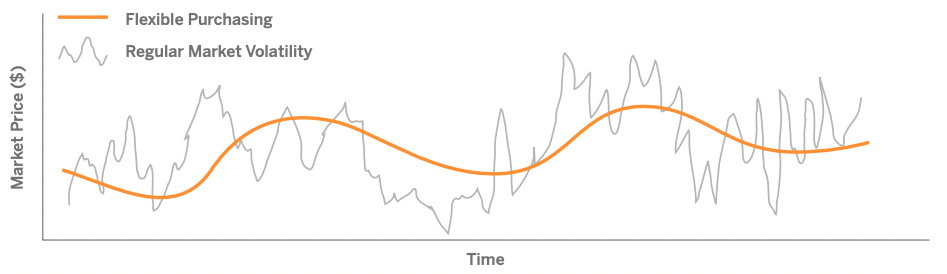

Flexible Strategy

A flexible strategy allows you to use risk to your benefit so you can achieve budget certainty while taking advantage of market fluctuations.

Index Price

An index price strategy allows you to take advantage of market lows — but also exposes you to market highs, which can make it difficult to achieve budget certainty.

Choosing a strategy that aligns with your level of risk tolerance can help you make better decisions for your company. To learn more and determine which strategy is right for you, contact us.